Getting The Taxonomy To Work

Wiki Article

Getting My Tax Avoidance To Work

Table of ContentsThe smart Trick of Tax As Distinguished From License Fee That Nobody is DiscussingSome Known Details About Tax Avoidance And Tax Evasion The 10-Minute Rule for Tax Avoidance MeaningTax Avoidance And Tax Evasion Things To Know Before You Get ThisWhat Does Tax Accounting Mean?Tax Avoidance Meaning Can Be Fun For AnyoneSome Of Taxonomy

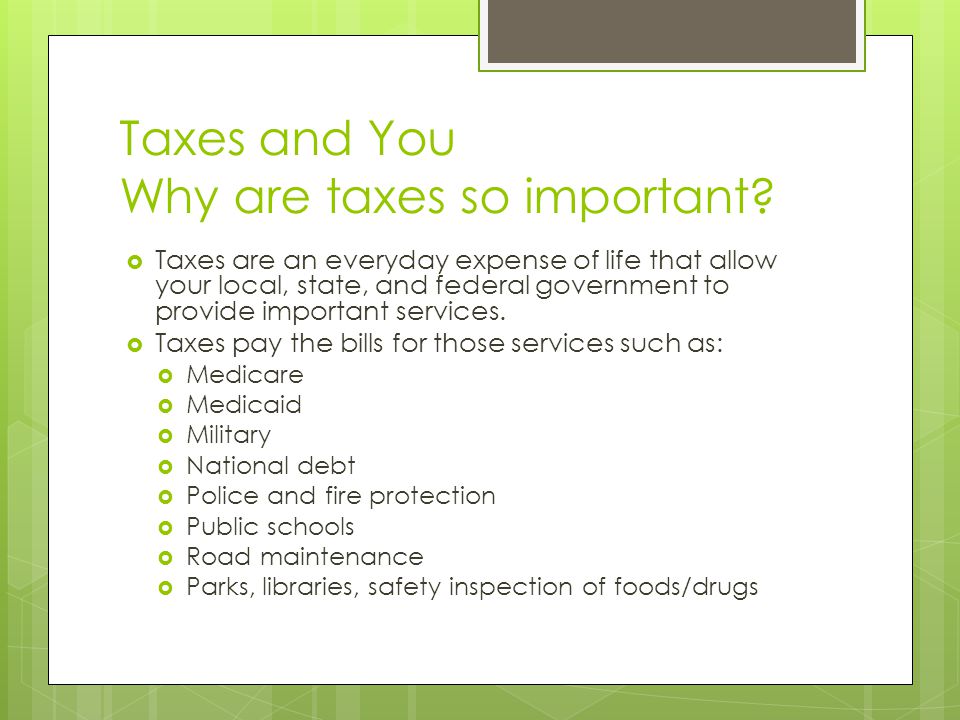

Further Analysis, For a lot more on earnings tax obligation, see this Northwestern Regulation College post and also this College of Chicago Law Evaluation post.Intro Throughout background, every arranged society had some type of government. In free cultures, the objectives of federal government have actually been to safeguard individual liberties and also to promote the health of culture overall. To meet their costs, federal government demand revenue, called "income," which it raises with tax obligations. In our country, federal governments levy a number of different kinds of tax obligations on people and also organizations.

The Buzz on Tax

The capitalism system does not generate all the solutions needed by culture. Some solutions are more successfully given when government firms prepare as well as provide them. Two examples are nationwide defense and also state or local cops defense. Everybody gain from these solutions, as well as one of the most practical means to spend for them is via taxes, as opposed to a system of solution costs.These controls typically add prices to the rate of new automobiles. There are likewise regulations to manage such points as using billboards and indicators along highways. Various other regulations manage reclaiming land after strip mining, discarding hazardous waste into streams and also rivers, and sound pollution at airport terminals. The free business system is based upon competition amongst organizations.

To make certain that a level of competitors exists, the Federal Government applies strict "antitrust" laws to prevent anybody from obtaining monopoly control over a market. Some services, called "natural monopolies," are more effectively supplied when there is competition - tax amnesty. The best-known examples are the utility business, which offer water, gas, and also electrical energy for residence and also business usage.

The Buzz on Tax Avoidance

The capitalism system presumes that customers are experienced about the high quality or safety and security of what they purchase. Nonetheless, in our modern culture, it is frequently impossible for customers to make informed choices. For public defense, federal government firms at the Federal, State, and local levels problem as well as apply regulations. There are regulations to cover the high quality as well as security of such things as home construction, automobiles, and electrical home appliances.

Another essential form of consumer defense is the usage of licenses to prevent unqualified individuals from functioning in particular fields, such as medication or the structure professions. City and also region governments have the main duty for primary and secondary education and learning.

Federal gives used for carrying out study are a vital resource of cash for universities and universities. Because the 1930s, the Federal Government has been offering income or solutions, usually called a "safety net," for those in requirement. Significant programs include health solutions for the senior and also monetary aid for the disabled and jobless.

10 Simple Techniques For Tax Accounting

Tax obligations in the United States Federal governments pay for these solutions with revenue acquired by straining 3 financial bases: earnings, consumption and wealth. The Federal Government taxes income as its primary source of profits. State federal governments make use of tax obligations on have a peek at these guys income as well as consumption, while neighborhood federal governments rely practically totally on taxing residential property and wide range.The personal revenue tax obligation creates about 5 times as much income as the corporate revenue tax obligation. Not all revenue tax tired in the very same way.

By contrast, the rate of interest they earn on cash in a regular savings account obtains included with earnings, incomes and also various other "average" income. tax avoidance meaning. There are also lots of types of tax-exempt as well as tax-deferred savings intends readily available that influence on individuals's taxes. Pay-roll tax obligations are a crucial resource of income for the Federal tax collector Federal government.

The Best Strategy To Use For Tax Avoidance

Some state federal governments likewise utilize payroll taxes to pay for the state's joblessness compensation programs. Over the years, the quantity paid in social protection taxes has actually considerably enhanced.Taxes on Intake The most important taxes on usage are sales and also excise taxes. Sales tax obligations generally get paid on such things as cars and trucks, clothes and film tickets.

Instances of things based on Federal import tax tax obligations are heavy tires, fishing equipment, plane tickets, gas, beer and also alcohol, weapons, and cigarettes. The objective of excise taxation is to place the concern of paying the tax on the consumer. her response An example of this use excise tax obligations is the gas excise tax obligation.

The 45-Second Trick For Tax Avoidance Meaning

Only individuals who buy fuel-- who utilize the freeways-- pay the tax. Some products obtain tired to inhibit their usage. This relates to excise tax obligations on alcohol and tobacco. Import tax tax obligations are likewise made use of throughout a war or national emergency. By increasing the price of scarce items, the federal government can lower the demand for these items.A lot of regions tax obligation private homes, land, and service property based on the home's worth. Usually, the taxes get paid monthly in addition to the home loan repayment. The one that holds the home mortgage, such as a financial institution, holds the cash in an "escrow" account. Payments after that get produced the building owner.

Examine This Report about Tax As Distinguished From License Fee

Those with high taxed revenues pay a bigger percent of their revenue in tax obligations. Since those with greater taxable revenues pay a higher percentage, the Government revenue tax obligation is a "dynamic" tax obligation.Report this wiki page